Amidst unfavorable geopolitical conditions and macro-economic headwinds, Immobel maintained a robust position within the real estate sector over the first half of 2022.

-

Immobel’s Net profit Group share amounted to EUR 9.1 million over the first half of 2022. The decrease compared to the first half of 2021 comes as no surprise, also given the fact that 2021 was Immobel’s second-best year ever. The anticipated decline was mainly due to residential permitting delays in the past years. Delays in the launch of certain new projects, due to current macro-economic conditions, also influenced the figure.

-

Immobel saw a slowdown in residential demand, due to rising interest rates and overall macroeconomic headwinds, including high inflation. Overall, Immobel was able to protect its margins and the decrease in revenues and earnings is only slightly below the expected range. Real estate investments declined in all segments with reduced liquidity in capital markets during the second quarter of 2022. However, Immobel’s key office projects are in European cities that are characterised by a low supply of Grade A sustainable offices, with increasing rents. Similarly, the high-quality residential products sit mostly within the higher market segment. Such positioning will continue to be a key driver of the business as Immobel’s portfolio remains attractive to investors and end users.

-

To date, Immobel has obtained final permits for EUR 292 million.

-

Immobel consolidated its position by acquiring a project in Brussels (BE) and Berlin (DE). In addition, a binding agreement was reached to redevelop the Proximus headquarters in Brussels (BE). The GDV1of the portfolio rose to EUR 6.2 billion at 30 June 2022.

-

Immobel Capital Partners, which was launched in January, completed its first transaction by acquiring an office park in Leeds (UK). The focus of Immobel Capital Partners is to create a ‘green’ pan European investment strategy in both the office and residential sectors. The Immobel Capital Partners team took shape in H1 2022, it established a diverse senior team, recognized in the European real estate sector and with an outstanding track record.

-

At this stage, Immobel does not foresee to deviate from its dividend policy.

Financials | Lower revenues and earnings, within anticipated range

The table below provides the key consolidated figures for H1 2022 (in EUR million):

|

30/06/22 |

30/06/21 |

Difference |

|

|

Revenues and other operating income |

130.8 |

183.8 |

-28.8% |

|

EBITDA2 |

16.6 |

36.7 |

-54.7% |

|

Net profit Group share |

9.1 |

29.9 |

-69.4% |

|

Net profit group share per share (EUR/share) |

0.9 |

3 |

-69.5% |

|

Balance sheet |

30/06/22 |

31/12/21 |

Difference |

|

Inventory3 |

1,315.2 |

1,261.9 |

4.2% |

|

Equity Group share |

551.2 |

571.6 |

-3.6% |

|

Net debt4 |

646.5 |

593.3 |

9.0% |

|

Portfolio GDV (in EUR billion)5 |

6.2 |

5.5 |

12.7% |

Revenues and Net profit group share for the half year to 30 June 2022 were EUR 130.8 million and EUR 9.1 million, a decrease of respectively 28.8% and 69.4%.

The decrease compared to the same period last year comes as no surprise, also given the fact that 2021 was Immobel’s second-best year ever. The anticipated decline in revenues and earnings was due to residential permitting delays over the past few years, and the costs associated with the launch of Immobel Capital Partners as well as an operational loss for its French subsidiary. This was further impacted by the current macro-economic headwinds, characterised by high construction inflation, rising interest rates and issues with the construction material supply chain. This delayed the launch of several new projects and resulted in a softening in residential sales. Overall Immobel was able to protect its margins. While the economic uncertainty will probably continue for the foreseeable future, Immobel’s office activity could contribute to an improvement of the net profit

The net debt position, GDV of the portfolio and inventory all grew proportionally following acquisitions during H1 2022.

Our strong balance sheet (debt ratio[1] at 56.0%) and solid cash position of EUR 263.6 million will enable us to weather the current market conditions. In June, Immobel strengthened its balance sheet with the issuance of a EUR 125 million green bond. “The issuance of this bond will allow us to continue developing our projects with high sustainability requirements. The success of this transaction is a clear sign of continued investor interest in environmental concerns and shows the investor confidence in our company,” explains Karel Breda, Chief Financial Officer.

Business update | Well positioned in residential and office markets

Despite the macro-economic backdrop, Immobel is well positioned in its residential and office markets.

In the first half of 2022 Immobel sold The Woods[1] (10,000 m²) to a Belgian Family Office. The Woods is a modern redevelopment located in Hoeilaart (Flemish Brabant, BE).

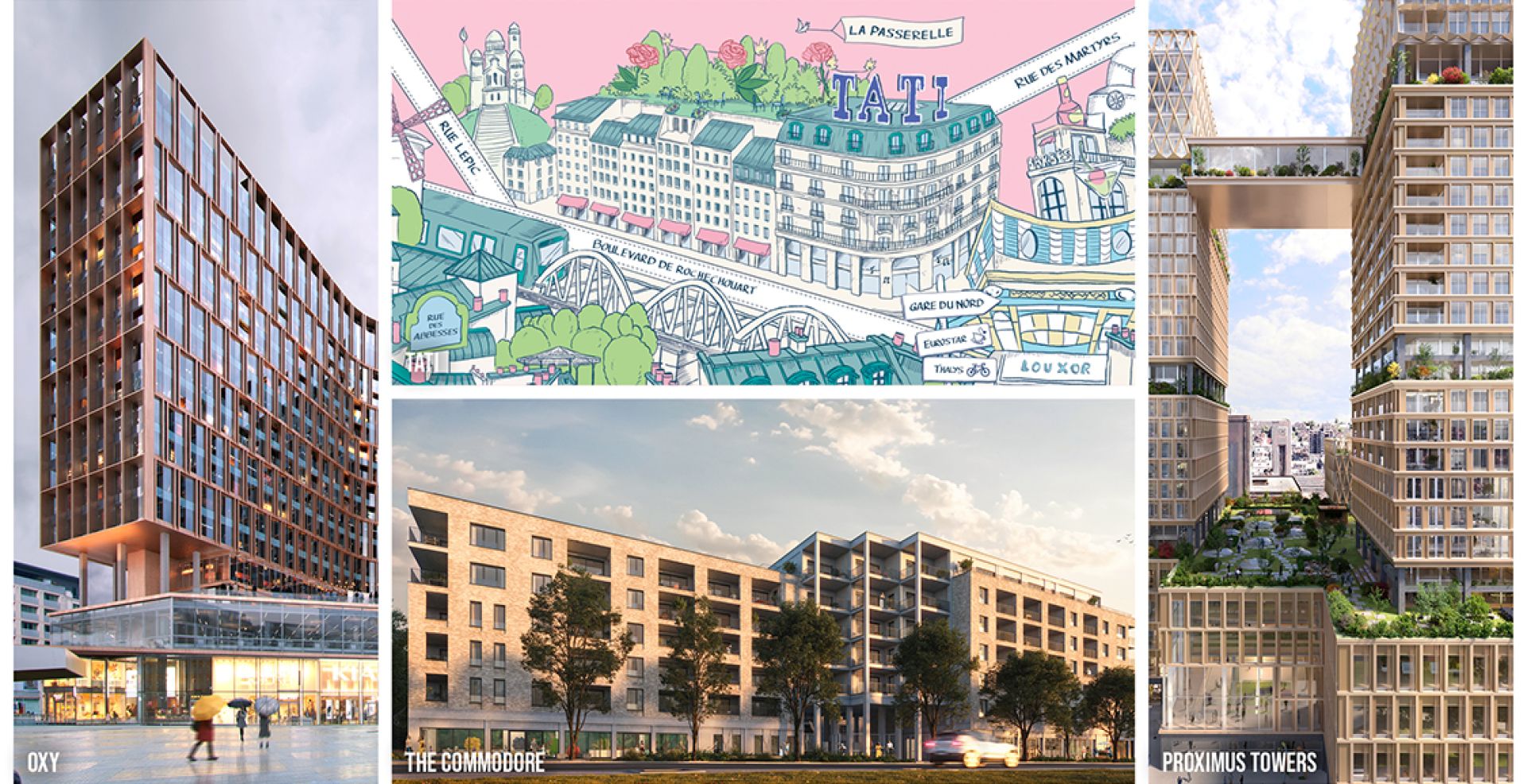

Immobel also launched the commercialization of O’SEA phase 3 (Ostend, BE), Slachthuis (Antwerp, BE), Lalys (Astene, BE), Fort d’Aubervilier (FR) and Liewen (Mamer, LUX) during the first half of 2022. These residential developments strengthened Immobel's status as a leader in its core markets. Immobel develops high-quality buildings designed by internationally known architects to ensure that developed areas become a vibrant environment.

O’Sea is a sustainable residential complex (229 apartments) located in the Belgian sea-town of Ostend, near the seafront. Creating a new perfectly integrated urban district, the complex will offer a wide variety of made to measure living spaces from houses, apartments, serviced residences, to studios.

Slachthuis is a mixed-use residential neighborhood (240,000 m²) with space for leisure, creativity, innovation, local business, culture, and education. It is situated in a strategic district of the city of Antwerp in Belgium. The new sustainable, high-tech campus for AP University of Applied Sciences and Arts is the first of many projects that will be turning the entire area into a bustling, green city district.

Lalys will be a new, cozy village district in rural Astene in Belgium. The location is exceptional, mobility-friendly and will become a pleasant place to live. The project is geared towards young families, with all 161 homes having three bedrooms.

Fort d’Aubervilier in France, near the outskirts of Paris, will provide 413 contemporary and bright residential units which will be centered around several parks, shared gardens, school groups, sports halls, services, and spaces dedicated to culture.

Liewen is an intergenerational neighborhood in a calm and green location. On the edge of the town of Mamer in Luxembourg, the new Liewen neighborhood, spanning three hectares, is a human- and nature-centered project which offers high-quality individual and common spaces and comprises 79 new high-quality homes optimally integrated into the existing green environment.

Permitting | Building the pipeline for the future

Immobel submitted a building permit for the Lebeau project in the Brussels Sablon district in the city centre. The project aims to transform the existing vacant logistics and office complex into a 35,000 m² dynamic mixed-use building providing 24/7 uses, and where working, living and leisure all exist hand in hand. The new project design takes into account the feedback from the district with regard to renovation, heritage, building density and sustainability. Neighborhood information and co-creation will also play a significant role in the new approach for the project.

Immobel also submitted the building permit to transform the PROXIMUS-TOWERS office building into a 120,000 m² future-oriented, and inclusive destination where people will live, work, study, relax, shop and play sports. The plans are in line with the new vision of the Brussels Region to transform the North Territory, including the North Quarter, into an accessible, safe, and connecting neighborhood for all its residents and users.

Following the suspension of the building permit for the redevelopment of the Brouck’R project by the Conseil d’Etat/Raad Van State, Immobel and BPI in consultation with Urban.BRUSSELS and the Secretary of State, decided to adapt the design of the project.

Permitting remains a challenge and certain projects, both in Belgium and in France, are subject to delays. To date, Immobel has obtained final permits for EUR 292 million over H1 2022.

Acquisitions and investments | Focusing on margins and operational efficiency

Immobel’s balance sheet is resilient, with EUR 263.6 million in cash available and a stable debt ratio of 56.0%.

To date, Immobel has closed deals in Brussels (BE) and Berlin (DE), bringing the total GDV of the portfolio to EUR 6.2 billion.

With the acquisition of the Commodore project in Evere (Brussels, BE), Immobel responds to the structural shortage of quality affordable housing in the city. Immobel is redeveloping a former peripheral office area into a pleasant and sustainable residential neighborhood with a pedestrian zone and cycle tracks in lush surroundings, creating three residential buildings with 115 apartments for about 300 families. Residents will benefit from a park with an orchard and a shared urban vegetable garden to promote biodiversity on-site. The buildings will be equipped with a rainwater recovery system, solar panels, green roofs, and a parking space for 229 bicycles to encourage soft mobility.

In Berlin Immobel finalized the acquisition of the Gutenbergstrasse project which consists of two high-rise apartment buildings with condominiums (in total about 220 apartments). An office building (5,855 m²) as well as a daycare centre and approx. 800 m² of commercial space will also be developed.

Over the first half of 2022, Immobel has taken a more prudent approach to new acquisitions. “In these very uncertain economic as well as geopolitical times, we will focus on the consolidation of our markets and on operational efficiency. Nevertheless, we are well positioned to create shareholder value, benefiting from our strong balance sheet and unique knowledge of our markets.” Comments Marnix Galle, Executive Chair of Immobel Group.

Immobel has significantly strengthened its Real Estate Investment Management activity since Immobel Capital Partners was founded in January 2022. Duncan Owen has reinforced the team with the addition of Monica O’Neill (Head of Capital and Investor Relations), Maureen Mahr von Staszewski (Head of Pan European Office) and since the half year, Melinda Knatchbull (Chief Financial and Operating Officer) and Andrew MacDonald (Head of Finance and Joint Ventures). All four have extensive experience in the fund management industry. In early March Immobel Capital Partners announced its first acquisition, an office park in Leeds (UK), which aligns with its plan to create a ‘Green’ pan-European investment strategy in the office and residential sectors.

A responsible approach

Over the first half of 2022, Immobel continued its efforts in the framework of its ESG strategy which resulted in various concrete actions.

With the goal to reduce the environmental footprint and to actively contribute to the vitality of the region, the Multi building, Immobel Brussels’ headquarters developed together with Whitewood, is now set for a circular future thanks to Madaster's digital materials passport8. Multi is the first renovation project in Belgium to receive a digital passport for materials in Madaster. Multi is also the first CO2-neutral office building to be commissioned in Brussels. Immobel’s enhanced sustainability approach is being translated into action through various projects with the Proximus towers being one of the most recent examples.

In terms of social engagement, the devastating consequences of the war in Ukraine brought Immobel to join the global donation movement. Immobel has identified KBF (“King Baudouin Foundation”) as a trusted partner to coordinate the allocation fund to support Ukraine through those four channels9.

The complete half-year report and the presentation are accessible on the Immobel website.

1 Sales value or gross development value: the expected total future turnover of the respective projects

2 EBITDA (Earnings Before Interest, Depreciation and Amortization) refers to the operating result (including share of result of associates and joint ventures, net of tax) before amortization, depreciation, and impairment of assets (as included in Administration Costs).

3 Inventory refers to Investment property, investments in joint ventures and associates, advances to joint ventures and associates, Inventories and Contract assets.

4 Net debt refers to the outstanding non-current and current financial debt offset by the cash and cash equivalents.

5 Sales value or gross development value: total expected future turnover (Group share) of a project or all projects in the current portfolio (including projects subject to conditions precedent for which the management judges there is a high likelyhood of closing).

6 Leverage refers to net debt / (net debt + equity – goodwill).

7 Through the sale of 2 SPV’s holding title to the project.

8 For more information: https://www.immobelgroup.com/en/news/the-materials-passport-used-for-the-first-time-in-a-major-renovation-project.

9 For more information: https://www.immobelgroup.com/en/news/immobel-joins-the-ukraine-donation-movement.