Solid recovery in 2nd half, largest pipeline ever. Immobel maintains its dividend policy.

-

Immobel realised in FY2020 revenues of EUR 375.4 million, EBITDA[1] of EUR 52.8 million and net group profit share of EUR 33.3 million or EUR 3.58 per share.

-

Business activities slowed down in the first half of the year due to COVID-19. A solid recovery took place in the 2nd half with normalised sales rhythms and permitting procedures.

-

Residential real estate continues to experience strong demand in every core market mainly driven by shortage of supply.

-

Institutional investor and tenant appetite for prime offices in Immobel’s core markets remain strong.

-

Immobel successfully launched its EUR 200 million Immobel BeLux Office Development Fund, enabling investments up to EUR 500 million.

-

While the company experienced delays in its permitting processes due to the health crisis and more challenging regulatory environments, the key catalyst for solid growth as from 2022 onwards is its permitting pipeline of more than EUR 1.4 billion in sales value[2] of mainly residential projects (4.500 apartments and houses[3]).

-

The company grew its portfolio with more than 13% up to EUR 5.1 billion in sales value by acquiring new projects for EUR 846 million mainly in Belgium, Luxembourg and France.

-

To support this investment and growth strategy, the company increased its equity by EUR 75.7 million through the placement of 1,162,179 treasury shares [4].

-

Immobel has decided to increase its dividend by 4%, resulting in a dividend of EUR 2.77 per share.

-

In 2020, Immobel has further strengthened its efforts to develop sustainable buildings integrating the relevant UN Sustainable Development Goals. In 2021, the company will also continue to improve its governance and reporting standards on sustainability according to the GRESB methodology.

Financials – noticeable impact of COVID-19

The table below provides key consolidated figures for FY2020 (EUR million):

|

Results |

31/12/2020 |

31/12/2019 |

Variance |

|

Revenues |

375.4 |

419.5 |

-11% |

|

EBITDA |

52.8 |

124.6 |

-58% |

|

Net profit Group share |

33.3 |

102.4 |

-68% |

|

Net profit per share (EUR/share) |

3.58 |

11.66 |

-69% |

|

ROE |

7.8% |

29.7% |

-74% |

|

Balance sheet |

31/12/2020 |

31/12/2019 |

Variance |

|

Inventory |

1140.8 |

961.1 |

19% |

|

Equity |

491.9 |

428.2 |

15% |

|

Net debt |

603.9 |

550.9 |

10% |

|

GDV (In BEUR) |

5.1 |

4.5 |

13% |

Revenues in FY2020 were mainly driven by the sale of an office building (Möbius I) in Belgium and residential sales in all countries (EUR 264 million).

While each of the P&L financial indicators have been impacted by a slowdown in sales and reduced construction activities in Q2 as a result of the lockdown, EBITDA and net profit group share have also evolved negatively due to the exceptional sales of Centre Etoile in Luxembourg and Möbius II in Belgium last year.

The sales value of the company’s portfolio grew by 13% from EUR 4.5 to 5.1 billion while the underlying inventory[5] grew by 19% to EUR 1.1 billion, driven by new acquisitions made in 2020. The increase in net debt was relatively limited, reflecting the proceeds from the placement of 900,000 treasury shares (in 2020; another 262,179 treasury shares were sold in January 2021), resulting in a gearing ratio of 55% (compared to 56% at the end of 2019).While each of the P&L financial indicators have been impacted by a slowdown in sales and reduced construction activities in Q2 as a result of the lockdown, EBITDA and net profit group share have also evolved negatively due to the exceptional sales of Centre Etoile in Luxembourg and Möbius II in Belgium last year. Revenues in FY2020 were mainly driven by the sale of an office building (Möbius I) in Belgium and residential sales in all countries (EUR 264 million).

Launch of Immobel BeLux Office Development Fund

In 2020, Immobel launched its real estate investment management services, offering its development capabilities to third party investors, be it in asset-specific joint ventures in European cities or through regulated discretionary funds. The Immobel BeLux Office Development Fund successfully achieved equity commitments for more than EUR 75 million from Institutional Investors and High Net Worth Individuals. Both the Total headquarters in Brussels and the Scorpio assets in Luxembourg will be proposed to the Fund as seed assets, with a view to developing and selling them once leased. The real estate investment management strategy will enable Immobel to accelerate its development in Europe, investing its balance sheet in more transactions, diversifying its project risks and finally to create an additional stable revenue line, further to its development project revenue resulting from its investment alongside investors.

Impact of the pandemic on sales

The company realized 10% fewer residential sales in 2020 compared to its objectives due to a slowdown of sales during the Q2 lockdown. In the second half of the year, sales recovered in each of its markets. Partly due to the effect of COVID-19, there was strong demand for more spacious homes and apartments both in urban as well as suburban areas. Projects that did well were O’Sea in Ostend, Eden in Frankfurt, Crown in Knokke, Lalys in Astene and Plateau d’Erpent in Erpent. Also in Gdansk, the sale of apartments in the Granary Island project (phase 2) was very successful; 180 were sold by the end of 2020. In the Vaartkomproject in Leuven, the company sold a residential complex for elderly people. Furthermore, Immobel signed a 9-year lease agreement with ING for a large office project in the European Quarter of Brussels.

Permitting pipeline of more than EUR 1.4 billion in sales value of mainly residential projects as a catalyst for solid growth from 2022 onwards

The health crisis as well as more challenging regulatory environments resulted in fewer new real estate projects being permitted in 2020 across the markets in which Immobel is active. This resulted the supply of new-build residential projects being at a historical low, supporting strong demand and prices for residential real estate even more. In 2020, Immobel obtained permits representing a sales value of EUR 314 million and currently has pending permit applications worth over EUR 1.4 billion in sales value. Key projects for which Immobel expects to obtain permits in 2021 are among others A’Rive (the former Key West) (529 units), Brouck’R (303 units) and Ilot Saint Roch (291 units) in Belgium, Polvermillen (216 units) in Luxembourg, Buttes Chaumont (60 units) and Bussy St Georges (223 units) in France. With the launch of construction and commercialization of these projects expected in the course of 2021, these projects will significantly contribute to the results as from 2022 onwards.

Acquisitions for growth

Thanks to its strong balance sheet with EUR 148.1 million of cash and EUR 75.7 million additional equity raised through the sale of its treasury shares, Immobel grew its portfolio with more than 13% to EUR 5.1 billion by acquiring assets worth EUR 845 million in sales value.

In Belgium (sales value portfolio: EUR 2.6 billion), Immobel won the Brussels South Station project (in partnership) and bought 50% of the shares in Brouckère Tower Invest SA for the Multi office tower in Brussels city centre. At the end of 2020, it acquired a number of office buildings and sites in Brussels from the French company Total, an ambitious circular redevelopment project.

Immobel Luxembourg (sales value portfolio: EUR 1.1 billion) bought shares of land plots in Schoettermarial with a view to developing a residential project of approximately 22,000 m². It also obtained exclusivity for a ‘cradle-to-cradle’ project of some 23,000 m² in Luxembourg City. Immobel Luxembourg also purchased the Scorpio project, a 3,700 m² office building located in Cloche d’Or. Finally, Canal in Esch-sur-Alzette was acquired: a listed building of some 6,000 m², a renovation and an extension for residential use and services.

In France (sales value portfolio: EUR 0.9 billion), the team signed a provisional sales agreement for a 3,000 m² office project in Pantin (Seine-Saint-Denis) and entered into purchase options for new residential projects for a sales value of EUR 114 million in Buttes Chaumont, Montévrain, Neuilly sur Marne, Othis and Romainville.

A plan for more sustainable cities and communities

To further increase the company’s commitment of structurally integrating sustainability into our projects, it has drawn up a plan with four concrete pillars that are linked to the United Nations Sustainable Development Goals. In 2021, we will take the next steps in this regard, with concrete KPIs and evaluation of our projects using GRESB benchmarking.

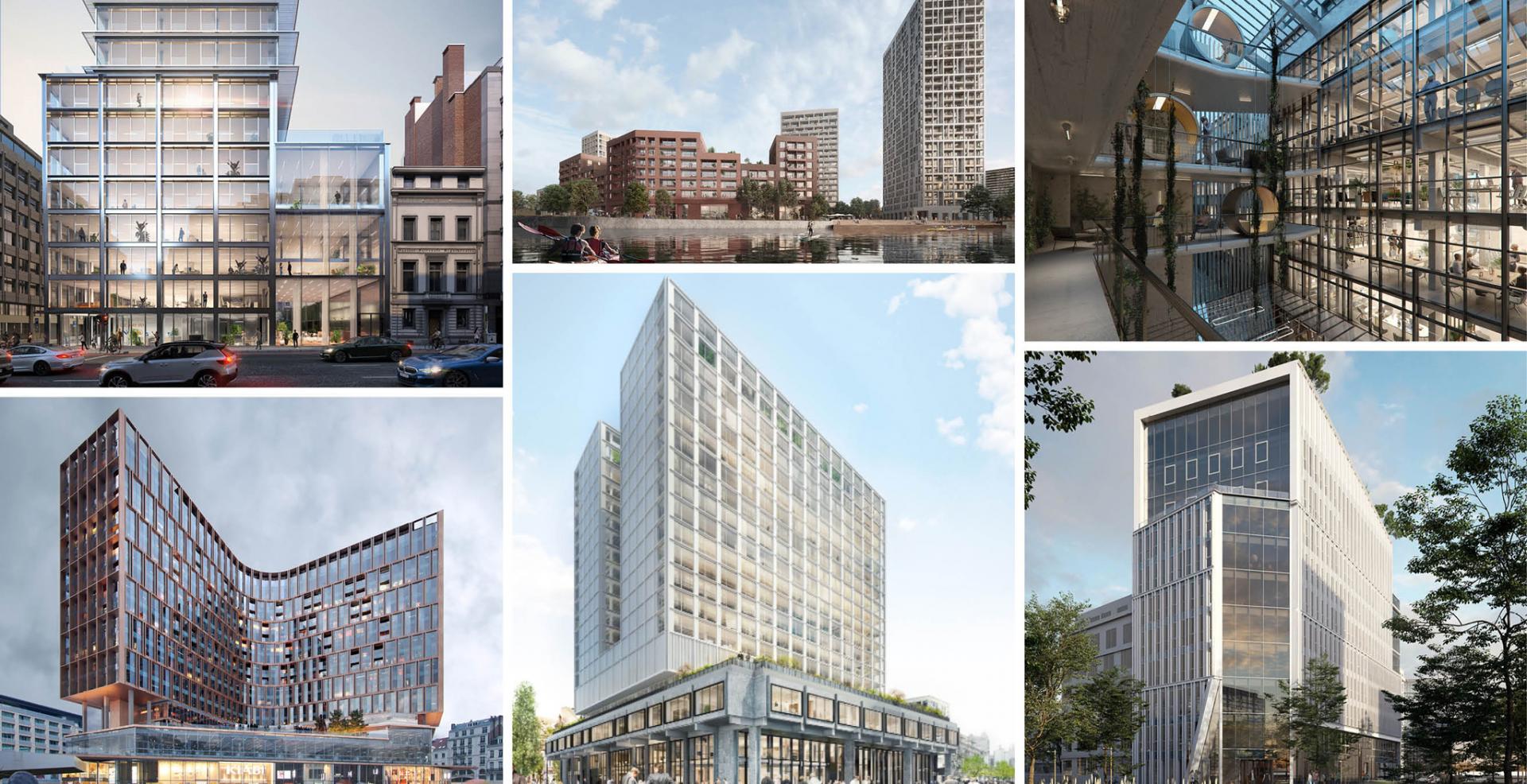

Positioning and identity

Since the merger in 2016, Immobel has evolved significantly. For this reason, the company also considered its positioning and communication in 2020. Based on surveys with different stakeholders and a number of internal workshops at all company levels and in all countries where Immobel has a presence, a new visual identity was also created that will be reflected in all business communications in 2021.

The statutory auditor, Deloitte Bedrijfsrevisoren CVBA, represented by Kurt Dehoorne, has confirmed that the audit, which is substantially complete, has not to date revealed any material misstatement in the draft consolidated income statement, consolidated statement of comprehensive income, consolidated statement of financial position and consolidated statement of cash flows, and that the accounting data reported in the press release is consistent, in all material respects, with the draft consolidated income statement, consolidated statement of comprehensive income, consolidated statement of financial position and consolidated statement of cash flows from which it has been derived.

[1] EBITDA (Earnings Before Interest, Depreciation and Amortization) refers to the operating result before amortization, depreciation and impairment of assets (as included in Administration Costs)

[2] Sales value or gross development value: the expected total future turnover (Group share) of the respective projects

[3] Total number of apartments and houses on a 100% basis

[4] Including the treasury share sale of 5 January 2021.

[5] Inventory refers to investment property, investments in joint ventures and associates, advances to joint ventures and associates, inventories and contract assets.